PaymentViews #8 — Gediminas Griška, Head of Payments at Hostinger

by Matthieu Couet on

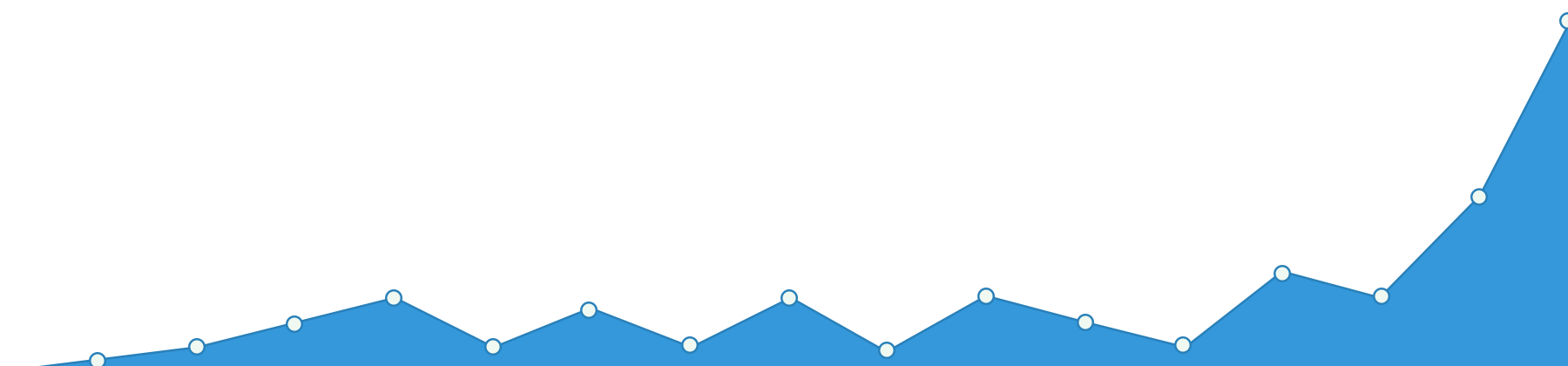

Born in 2004, Hostinger has grown significantly over the years and now has over 29 million customers in 178 countries. As a result of this impressive growth, Hostinger faced the challenge of building a payment infrastructure that addresses the world and partnered with us to do so in an optimized and flexible way. Hostinger offers easy-to-use and scalable hosting solutions, allowing users to build and grow their websites. The Lithuanian company is customer-obsessed, keeping its users at the forefront when developing products.