Interchange Plus pricing vs. Tiered pricing

by Gregoire Delpit on

In a recent post we went through the different layers that compose a payment fee (here). It’s time to talk about money. When it comes to payment fees, there are 2 main pricing models: Tiered and Interchange Plus. Here is a short overview of those 2 models and a quick way to start saving on fees.

Tiered pricing is for newbies:

Tiered pricing is pretty easy to understand. Your payment provider defines what is a standard transaction and each standard transaction is charged using the same formula. In the US entry tiered pricing is 2.9% + 0.3cts per transaction. In Europe it’s 1.4% + 0.25cts per transaction.

For transactions that are not considered as standard by your payment providers a markup is added. Qualification of the transactions & markups depend of payment providers:

- Some providers will consider Amex transactions as non standard and will add a markup;

- In Europe, some providers will add a markup when the transaction is realized with a non-European card;

- Some providers will add a markup depending on the security checks;

- …

Sometimes your payment providers can decide that all transactions be treated as standard transactions and thus offer a single pricing for all transactions. This specific type of Tiered pricing is called Blended pricing.

Tiered pricing / Blended pricing are the simplest models and are opened to any merchant accepting payments. Most online merchants start with a Blended pricing and then switch to Tiered pricing. However when volumes increase merchants want to have more bargaining power and transparency and ask for Interchange Plus pricing.

Interchange Plus pricing is a must:

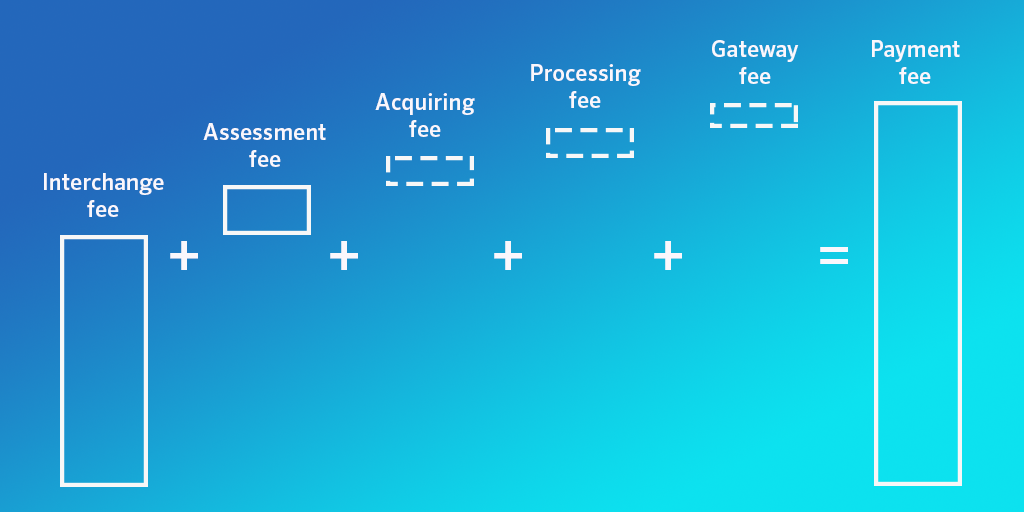

Interchange Plus pricing model is a bit more complex than Tiered pricing. If you remember our first article on payment fees (here) you should have in mind that various providers are implied in a transaction and that each of them take a part of the payment fee paid on each transaction. Here is a chart from our last post if you need a quick refresh:

Also we’ve seen that Interchange fees go to the Issuing Bank (the bank of the customer), Assessment fees go to the card network and that only Acquiring, Processing and Gateway fees were for the merchant’s payment provider. Last but not least we’ve also seen that the percentage taken by the Issuing Bank (Interchange fee) and the card network (Assessment fee) vary depending of transactions’ parameters (issuing bank, type of card, country, security checks, … ). It means that for a merchant’s payment provider the cost to process its transactions vary from one to another.

Interchange Plus is a pricing model where your payment provider will only take a markup on top of Interchange & Assessment fees. As Interchange & Assessment fees vary, it means that pricing is not fixed and will change depending of transactions. It also means that pricing is more transparent as you will negotiate with your payment provider the markup it takes on each transaction. For online merchants, Interchange Plus pricing is a bit more complex to monitor but is much more transparent and cost effective than Tiered pricing.

Am I overpaying on fees?

Payment fees can be very expensive. With a basis pricing at 2.9% + 0.3cts and additional markups (non standard transactions, foreign currencies…) it can go up to 5% or 6% if not managed and negotiated properly. Lots of merchants are not even aware of the global cost because most of the time they do not track it or because it’s not easy to gather all the information.

However this is something that SaaS & eCommerce should track as there is lots of money at stake. Between a merchant that manages properly its payments and one that does not you can have up to 3% of difference… if your business makes around $1m it’s $30k and if you make $10m… Well you know how to do the math.

At ProcessOut we’re convinced that payment fees are a major point of saving for online businesses. To help online merchants realize this we’ve created a free and easy to set up tool that track and benchmark fees. It helps merchants have a global view of payment costs and provided actionable insights to decrease fees.

It’s compatible with Adyen, Stripe, Braintree & Be2Bill and can be activated in less than a minute without any technical integration.

Next post will explain what parameters are analyzed by your payment providers to define its pricing offer. If you’re able to understand what you’re really charged and how it can be decreased we will have succeeded. Have a look here… Hope it helps!