How to build a chargeback monitoring strategy with ProcessOut?

by Jeremy Lejoux on

For most merchants, chargebacks are synonyms of lost revenue. Typically, a chargeback happens when one of your customers sees a payment on their bank statement that they don’t recognize and contest it with their banks. Often, the bank will accept the dispute and will escalate it to your Payment Service Provider (PSP) or Acquirer, which means additional hassle in dealing with it, and lost revenue coupled with fines.

However, what’s often left out of the equation is that more often than not, chargebacks come with a deeper level of data available. This data can be useful for tracking, but also for understanding the root cause of the fraud you’re receiving to act upon it and catch it early.

How to properly monitor and handle disputes

Fortunately, principal card schemes (such as Visa, Mastercard or American Express) have programs in place allowing you to access this data. For example, we can categorize disputes in 3 main categories:

- Requests for Information: the cardholder doesn’t recognize a transaction on its bank statements. This isn’t an actual chargeback but is rather a way for the merchant to act early by providing additional context around a transaction to help the cardholder.

- Notification of Fraud (also known as TC40 for Visa and SAFE for Mastercard): the user is initiating a chargeback but it hasn’t converted to one yet. It can be an occasion for you to reach out to the user before the chargeback gets processed, or you could directly issue a pre-emptive refund to try to avoid the upcoming chargeback.

- Chargebacks: this is the dispute kind that we all know: the cardholder disputed a transaction and you need to contest the dispute to recover the funds. However, what’s less known is that every chargeback also comes with a set of metadata to give you more context about the dispute as well, such as if the cardholder/issuing bank considered the transaction as a duplicate, fraud, or goods not received.

It’s also important to note that, although these programs exist, a Request for Information and a Notification Fraud doesn’t necessarily mean that a chargeback will follow. A chargeback might also never have any Request for Information or Notification of Fraud preceding it.

Ethoca built an online service that aims at helping them fight against chargebacks. To do so, they allow merchants and card issuers to work together by creating a large network of users. Through this network, it is possible for a merchant to be alerted when the customer asks information to his bank regarding a specific transaction that occurred on that merchant (i.e Requests for Information). By using their services you would be able to get notified before a chargeback occurs, and thus refund the transaction without being impacted by card schemes.

How you should build your vision around fraud

We’ve seen that great tools can be used to bring greater visibility into your fraud in order to better understand and combat it. However, it can be tedious to visualize all this data— especially at scale— which makes it harder to act upon.

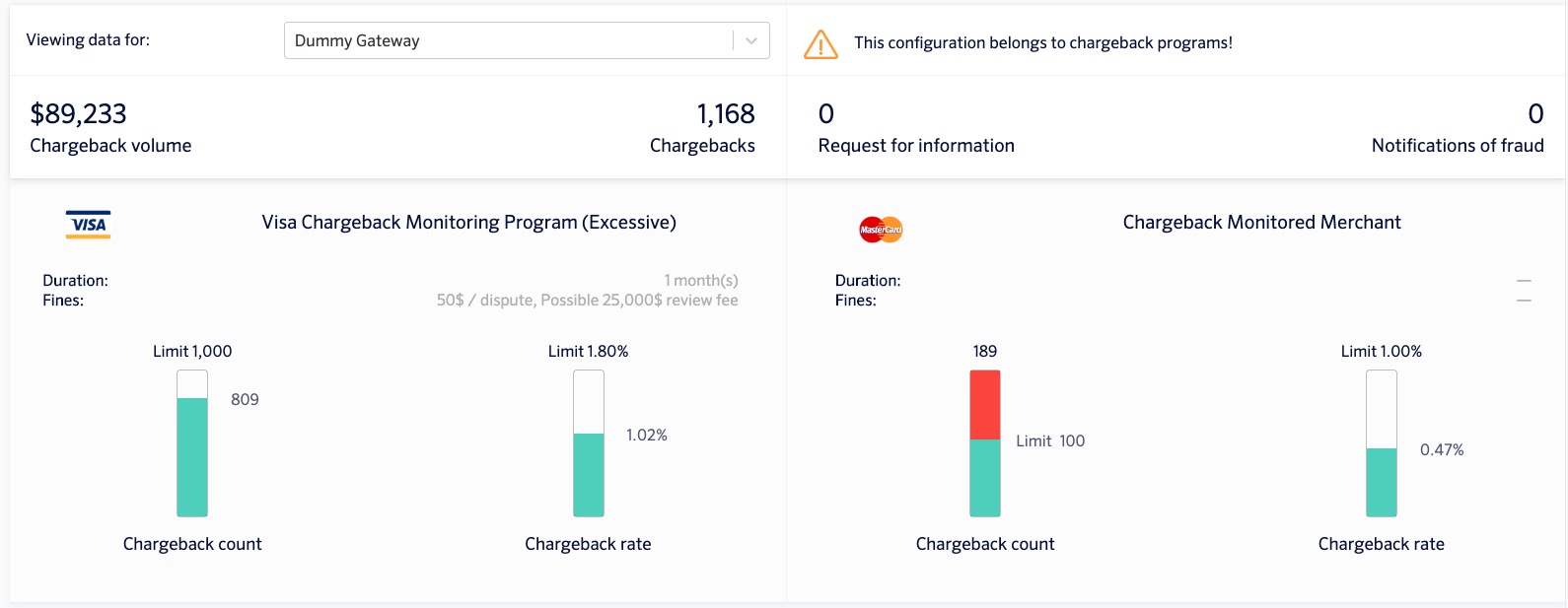

Fortunately, ProcessOut’s payment analytics, monitoring, and intelligence tools allow companies like Glovo, Veepee (formerly Vente-Privee) or oui.SNCF to dive into this data with ease and get a clear view of their fraud. Understanding the origin of an influx of fraud can be done in a few clicks with our data explorer to pin-point specific countries, issuing banks or even BINs.

Lately this past year, we released a feature that allows online merchants to effectively monitor their chargebacks ratio for both Visa & Mastercard chargeback programs. The idea behind this feature is to let the merchant know in which schemes programs they are enrolled, what fines they could be subject to.

Finally, combatting fraud should also be done at the root by actively blocking transactions before they commit fraud. ProcessOut also helps in the process by automatically connecting and integrating merchants to market-leading fraud-scoring services like Sift, or Ravelin to block transactions before they even occur or by forcing 3DS on transactions that support it to protect the merchant.