How to leverage multiple Payment Service Providers to grow your revenue

by Louis Terme on

A bit more than a decade ago, the payment ecosystem started becoming more and more complex as the appetite for online commerce skyrocketed among shoppers. The first generation of payment providers couldn’t serve anymore the growing need for merchants to be able to accept a wide variety of cards and payment methods across the globe. Back then, a new type of payment service providers (PSPs) emerged.

These new providers were developer-friendly, offered connections to multiple payment infrastructures worldwide as well as different types of services & technologies.

Relying on a single payment providers puts you at risk

This was a huge shift in the market and for sure merchants really benefited from the simplification of many painful processes along the payment chain. Unfortunately, the complexity of payments has continued growing on its own since then and soon enough merchants were facing other kinds of problems affecting their profitability: significant gaps in their acceptance rates depending on the region selling or due to risk assessment & technical reasons (on this subject read Why transactions fail), opaque layers of costs often hard to understand and thus to optimize payment fees (read Why and how you should optimize your payment fees) or even increasingly smarter fraudsters (…)

For merchants, it became clear that putting all their eggs in the same basket could potentially put their business at risk. Each merchant has specific needs in terms of payments due to numerous parameters such as its industry, geography, types of customers, etc… and not a single PSP can fit them all.

How giant businesses leverage multiple payment service providers

If you look at how giant businesses manage their payments, you’ll notice that these companies have entire teams dedicated to payments. Up to 50 persons work on payments full-time. Now let’s take a look at how are structured these teams and what they do:

- Developers integrate new gateways, direct connections to acquirers or alternative payment methods. They build the internal architecture connecting all these services together and ensure everything is working smoothly.

- Data analysts gather all the payment data into dashboards to monitor the technical & financial performance of the transactions. They constantly run analysis and benchmark their dataset to define what routing rule will result in revenue growth.

- Business executives handle all the partnerships with PSPs, contract negotiations (…)

This looks very promising of course. However, building an internal multi-PSP infrastructure is often a time consuming and costly process that can take years to achieve, which is not what you want to focus on especially if you’re growing fast. Building a performing multiple payment providers infrastructure implies to iterate a lot, A/B testing your providers according to different parameters of your transactions: the country, the amount, the card network, the issuing bank… Some providers are more familiar with certain patterns of transactions. To get an efficient payment infrastructure, you first need to understand which providers will be able to deliver the best possible performance to your own business profile and specificities.

Leveraging third-party providers to go multi-PSP

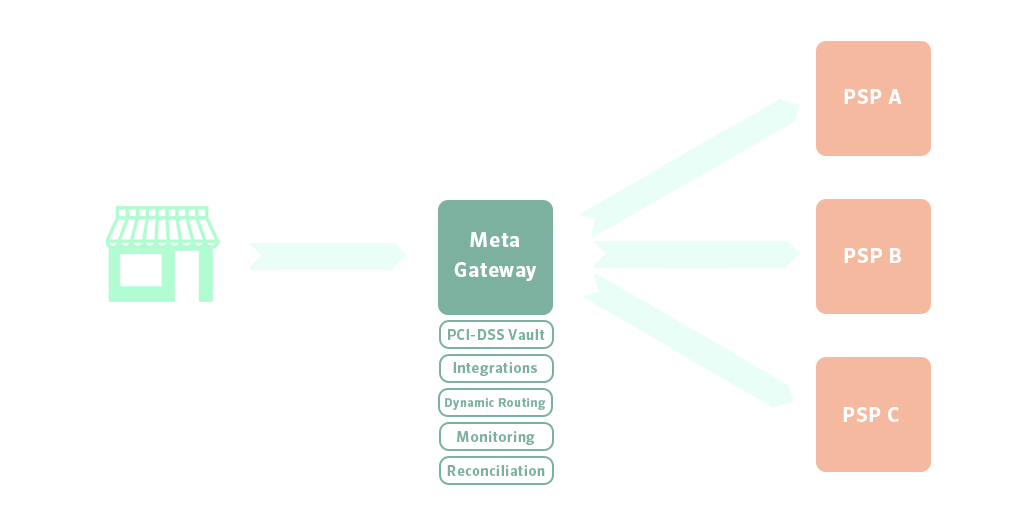

A new kind of agnostic provider has appeared to help merchants successfully leverage multiple payment service providers and optimize their payment performance. Also called Payment Orchestration Platforms, they act as a meta gateway and sit between the merchant and its providers. Here are the key tools they should be offering to provide the merchant with enough flexibility to leverage several PSPs:

- PCI-DSS Vault: in order to securely tokenize customers’ cards at the merchant level and become independent from their PSPs while taking the PCI burden off the merchant’s shoulders.

- Integrations: the provider’s API should allow the merchant to activate easily any payment service provider without having to develop new integrations on their side.

- Dynamic Routing: gives the possibility of optimizing either the acceptance rate or the fees by routing payments using any parameter of a transaction (BIN, Currency, Issuing Bank …) and retrying failed transactions across different PSPs.

- Monitoring & Reconciliation: a single dashboard to unify, analyze and harmonize payment data from all the providers used by the merchant as well as a single reconciliation file.

When should you start using multiple payment service providers?

Payment performance problems generally start to appear when a merchant is going through a growth phase. Either the level of declining transactions begins to increase or the chargeback rate, resulting in high payment fees. As soon as these problems start impacting significantly the revenue of the merchant, he should start analyzing precisely the origin of the problem and the limits of his PSP’s performance. For example, opening new markets should bring questions such as processing cross-border or opening a local merchant account and offer customers alternative payment methods (…). However, taking the decision of adding a new provider to its stack requires payment expertise which a merchant hasn’t necessarily developed internally.

At ProcessOut we have built Telescope, a free audit tool for payments that work with no technical integration. The goal of Telescope is to help merchants understand what performs well and what doesn’t in their current setup. An algorithm generates personalized & actionable recommendations to optimize the payment performance and if it makes sense, Telescope will automatically suggest merchants add a new provider. Because we monitor payment data from more than 200 merchants worldwide, we are able to provide our users with a benchmark on their performance and tell them how much they could recover by leveraging multiple payment providers.

Going multi-PSP can be done in a click-through ProcessOut’s API and we have developed a Smart-Routing engine to ensure our customers always get the best from their providers. If you’re interested to run a free audit and find out how much could be optimized, feel free to sign up right here or drop us a line at [email protected]