Why and how you should optimize your payment fees

by Louis Terme on

In this article, we will talk about payment fees and we will share some tips to optimize those. If you’re working in the financial or technical department of a company selling online this article is for you.

Payment Fees - A key driver for margins

Each time you accept a payment you pay a fee. We’ve already described the different layers of this fee and the different pricing models in these 2 articles: Payment fees at a glance and Payment fees, pricing structure so we won’t spend too much time on those subjects in this post.

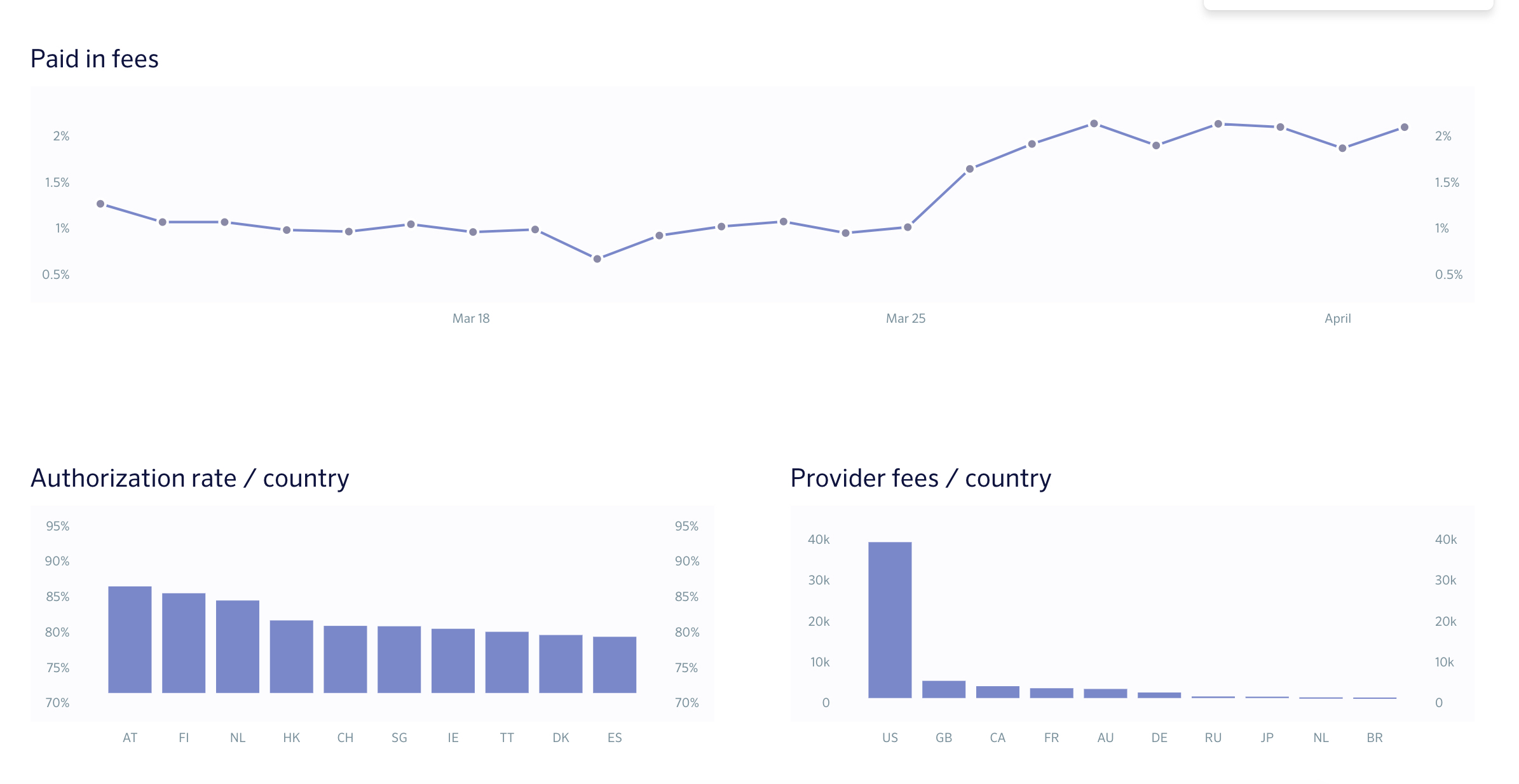

Long story short, payment fees are complex and expensive (up to 3% in Europe and 5% in the US) but payment fees can be strongly optimized. Helping merchants monitor & optimize their payment fees is part of our job at ProcessOut and we thought it might be interesting to share some tips to help you do the same.

Payment Fees - Key pricing parameters

To define the level of their fees, payment providers are going to assess a few parameters about your business & industry. Key parameters used by payment providers to set up the price are Volume; Risk profile; Chargeback ratio & card/transaction parameters:

Volume - It is the easiest parameter to understand. It’s a basic principle of most commercial transactions: “The more you buy, the more you can negotiate.” The more transactions you have the more you can negotiate the price with your payment provider. Volume is a key parameter but not the only one. We’ve seen some large merchants pay higher fees than small ones and this can be explained by the 3 other parameters that makes the fees.

Chargeback ratios - A chargeback is when a cardholder disputes a transaction charged on his or her card. To be compliant with the card network rules, your payment provider has to maintain a low level of chargebacks (at the time we wrote this article it was below 1% with Visa, below 1,5% with MasterCard and below 2% with CB). If your payment provider is not compliant, it will have to pay a fine plus it will negatively impact the way its transactions are scored by the Issuing Banks (banks that have issued the customer’s card). And as you may know… approving or declining a transaction when you’re an Issuing Bank is all about risk scoring. In other words, if your payment provider does not comply with the chargeback ratio of the card network it will have a negative impact on its financial & technical performance. Your level of chargebacks is thus a key pricing parameter.

.png)

MCC (Merchant Category Code) - Payment providers have noticed that fraud/chargeback ratios are very different from one industry to another. It is very important for a payment provider to take into account the industry of the merchant when assessing the risk to accept or decline a transaction. Payment providers have thus developed a global classification: MCC codes. Depending on its activity, each merchant will be categorized. This MCC code is a key parameter for the Issuing Bank to assess the risk of a transaction (and thus accept or decline it). It is also a key parameter for payment providers to evaluate the risk profile of a merchant so they can define the level of fees.

MCC & Chargeback ratios are therefore two very important parameters used by payment providers to set up the price. From our experience, it is as important (and even more) as volumes. Indeed to comply with card networks’ ratios, payment providers are always looking to onboard low-risk merchants. Our experience shows that if you’re able to maintain a level of chargeback below 0,1%, payment providers will be very very interested to have you as a customer and will most probably offer very good pricing.

Last but not least, as you may remember from our article on pricing, price depends on the transaction parameters (country, currency, type of card, security check). This is something you should also take into account when assessing the prices offered by your providers. Here are some general principles to remember:

- Fees are lower for European cards (entry fees for European cards are 1.4% + 20¢ vs. 2.9% + 30¢ for other areas)

- When accepting a foreign currency you will have to pay a commission and it can be pretty high (more than 1% most of the time)

- Fees are higher for business / corporate/commercial cards. The difference is especially true in Europe where commissions on corporate/commercial cards are not regulated contrarily to fees on consumer cards

- Fees can be different depending on the security check made during the payments. For example in Europe, a transaction with a 3DS check might have lower fees than a transaction without this check

As you can see, when it comes to online payments, fees depend on several parameters. The negative point is that it’s complex to understand. The positive aspect is that as for any complex pricing there is always space to negotiate… And trust us, when it comes to payment fees we, at ProcessOut, see huge differences between merchants!

Payment fees - Key principles to optimize

Payment fees are not a transparent market and if you want to have a good price you need to be in a position to negotiate. From our experiences, here are the key principles that will help you get great pricing:

Maintain a low chargeback ratio - This is the simplest. The lower your chargeback ratio will be, the more attractive you are for a payment provider. So if you want to negotiate great pricing be sure to take the relevant action to optimize your chargeback ratio.

Flexibility/work with several payment providers - It seems obvious when you say it but most of the time people tend to forget it: “The easiest way to drive prices down is… competition!”. Being in a position where you can easily put in competition your payment providers is key to decrease fees. Most of the time, merchants think about this when they negotiate their contract but then tend to work with a single provider. It means that when they want to negotiate again they are not in a good position to do it. On the other side, we see that merchants who work with different providers tend to succeed to negotiate fees along the road. It requires to make 2 integrations at the beginning but it tends to be profitable from a midterm point of view.

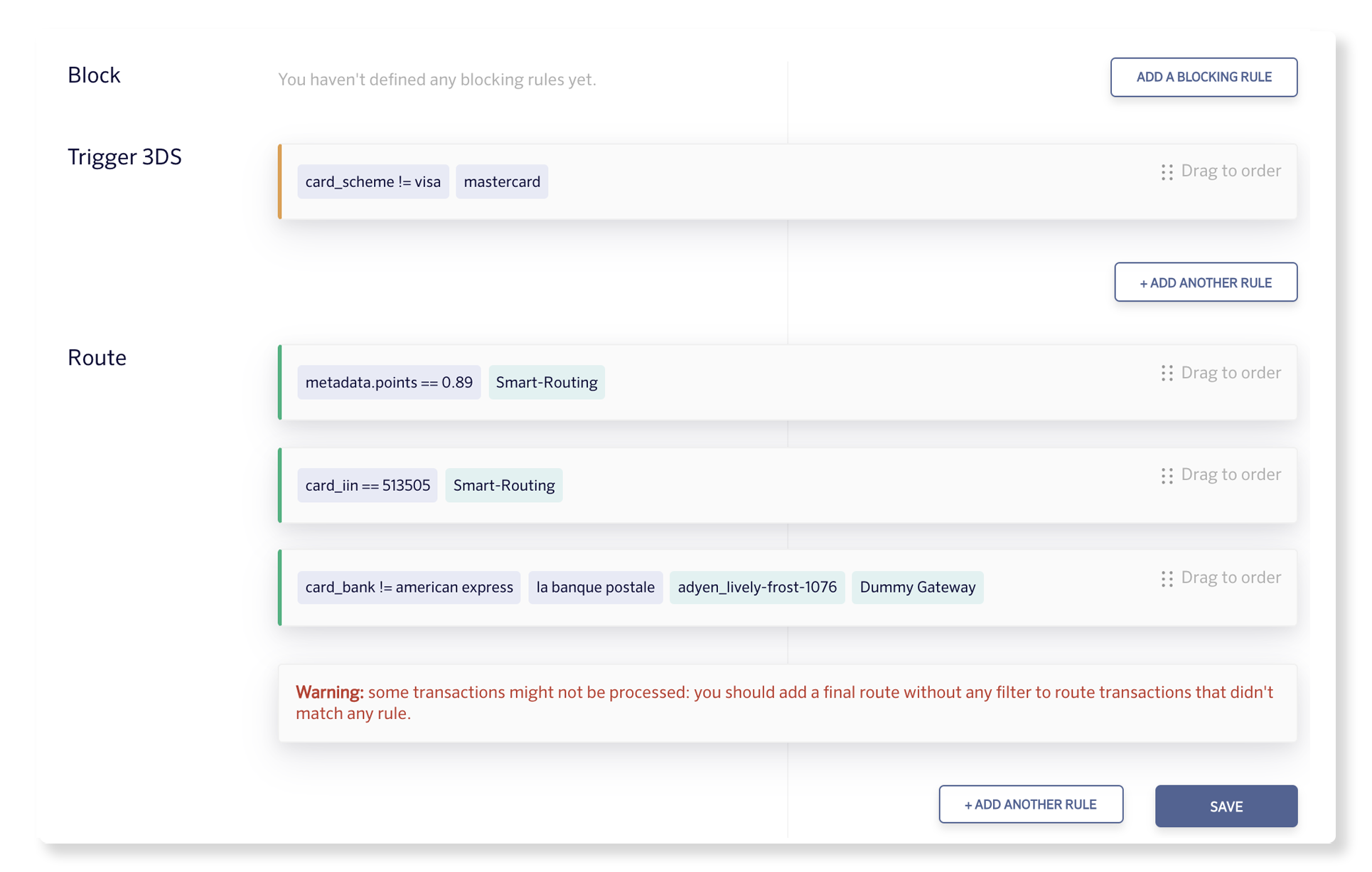

Smart routing/balance transactions - Best in class merchants tend to balance transactions between their different payment providers and to route transactions with 3 key principles in mind:

(i) maintain/protect their level of chargebacks for their key / strategic payment partners

(ii) take into account the different pricing conditions/parameters to optimize fees (for example between European & non-European cards)

(iii) take into account the performance of each provider (% of successful transactions)

Flexibility, routing & chargeback prevention are 3 key principles to set up in order to manage & scale a very cost-effective payment system. Indeed the mix of those 3 principles will put you in a very strong position to negotiate with your payment providers.

Here is an additional comment for mid & high-risk merchants (those which have a high level of chargebacks) which want to reduce fees: By implementing smart routing rules and smartly balance chargebacks between their different providers, we’ve seen some high-risk merchants succeed to achieve low levels of fees. They achieve this by working with a mix of providers (some which accept some risks and some less), by implementing fraud & security systems to decrease chargebacks and by closely monitor their chargeback ratio with their most competitive providers and balance their transactions depending on their risk profile.

ProcessOut - Smart routing

By building a flexible payment infrastructure, by routing each transaction to the relevant provider and by chasing chargebacks, those merchants are sure to have the best financial & technical performance on a short-term & mid-term point of view. It means that sometimes they will accept to pay a bit more on a specific transaction by routing it to a less competitive provider but to be sure to maintain a very low chargeback ratio with their most competitive providers.

At ProcessOut we help online merchants build, scale & manage their payment infrastructure. From our API any payment provider can be integrated into a single click. On top of that our smart routing solution analyzes in real-time each transaction to route it to the most relevant payment provider to optimize fees and decrease failed transactions. If you’re looking to decrease fees or failed transactions… let’s talk! We have already helped dozens of merchants improve their payment performance!

Let’s talk, feel free to send an email at [email protected]