Payments at Web Hosting & VPN companies

by Louis Terme on

In this article, we explain how Web Hosting & VPN companies use ProcessOut to manage and scale their payment infrastructure. We namely highlight flexibility, tokenization and retries, 3 key features to improve payment performance and decrease failed transactions.

.png)

A dynamic & fast-growing market

As you may know, Web Hosting & VPN are very dynamic sectors where some great companies flourish. A lot of those companies are pretty successful and expand quickly to reach several million in revenue. Indeed, as for most of those companies, their products can be subscribed to 100% online without any human interaction. This means that as soon as they find their market fit, revenues start growing pretty fast.

Scaling: The Payment Challenge

When scaling their business, companies will face what we could call the “payment challenge”. At some point failed transactions start to increase… Maintaining a low ratio of failed transactions becomes a challenge. Several things can explain why collecting & managing payments are not smooth processes for Web Hosting & VPN businesses. Among those are: manage recurring & pay as you go payments; collect payments from customers from very different countries & last but not least, manage fraud & maintain a decent ratio of chargebacks.

Building a flexible & efficient payment system

The solution is to build a more flexible and powerful payment infrastructure. Payment Orchestration Platforms and layers can be a great alternative. Most of Web Hosting & VPN companies work with recurring payments. Some have fixed plans and some have variable priced plans based on their users’ usage. It’s thus important for those companies to set up a payment infrastructure that is able to manage such a billing system. While designing their infrastructure, Web Hosting & VPN companies should pay attention to the following aspects

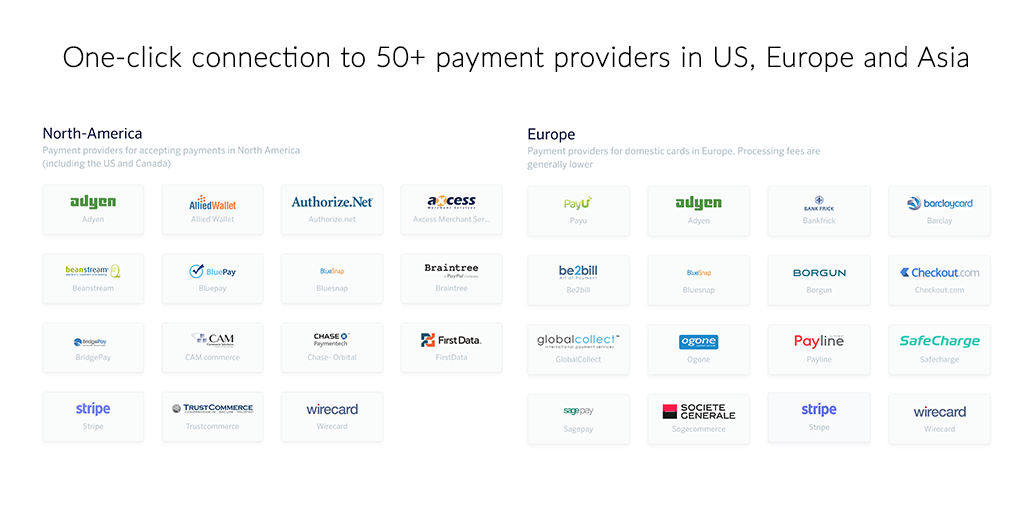

Ability to work with several PSPs - To reach a high percentage of successful transactions, those Web Hosting & VPN companies need to work with different PSPs. This will help route transactions to the most relevant ones in order to avoid downtimes and to maintain a decent level of chargebacks with each PSP. To do so, they must build a system where they can easily add a new PSP (to open a new country, to manage chargeback ratios, to add a new payment method…). They also need to be able to route transactions to the different PSPs and to centralize all their transactions in the single dashboard so they can manage their infrastructure, assess the performance of their different payment partners and adapt routing rules.

Tokenizing customers’ credit cards - Tokenizing a card means encrypting and storing the card’s information in a safe place. Usually, your payment provider does that for you, but if you had a way to do it at your own level you would gain flexibility and be able to send your transactions to the provider of your choice.

But as you may guess not everyone can do this. You need to be PCI-DSS level 1 (highest level of PCI certification) and as a merchant, you don’t want to become PCI-DSS level 1 because it’s a very long and expensive process. Instead, you can use an external vault that will just do the job for you and give you the flexibility you need.

Using the power of smart retries - If you’re able to tokenize your customers’ cards, you can set up a smart retry system for your recurring transactions. If a transaction fails on payment provider A, you can automatically retry the same transaction on payment provider B. Such a system can help you recover up to 30% of failed transactions.

.png)

ProcessOut- Build, manage & monitor your payment infrastructure

Implementing such an infrastructure takes some time but is worth from both the business & customer experience point of view. From a long-term point of view, a flexible payment infrastructure is a huge asset to scale the business and the sooner you implement it the easier it is. Some companies decide to build such an infrastructure internally while others rely on ProcessOut to do so.

We’re working with leading Web Hosting & VPN companies to set up & manage their payment architecture and tackle the payment challenge. From our API, any payment API can be integrated in a click, bringing flexibility and scalability to our customers’ payment infrastructure. On top of that, we build lots of features and options to help our users monitor, assess & improve their payment performance.

We’ve built Telescope, an algorithm based payment assistant that tracks your payment performance, detects which transactions failed & why, and makes personalized recommendations to decrease failed transactions and optimize fees.

.png)

We have several interesting use cases with Web Hosting & VPN companies. By using ProcessOut, some of those companies have been able to decrease failed transactions by more than 10 points and to divide payment fees by 2.

If you’re a VPN or Web Hosting company and want more information, feel free to ping me at [email protected]! I would love to hear your payment challenges and see if ProcessOut’s monitoring and smart routing solutions can help.