Payment fees at a glance

by Gregoire Delpit on

We are starting here a serie of posts on payment fees. The aim is to help you better understand how those fees are calculated and to give concrete insights in order to optimize those. Let’s start with the basics and talk about their different layers.

To get paid… you have to pay:

Payment fees are paid on a transaction per transaction basis. Most of the time online merchants are charged both a fixed fee and a % of the transaction. Some payment providers also ask for an additional flat monthly fee. As an example, players like Stripe or Braintree charge 2.9% + 30cts for each transaction. However, all this money is not kept by Stripe or Braintree…

As a loyal reader of ProcessOut’s blog I am sure you already know that several entities are involved in an online transaction : Gateway, acquirer, card network, issuing bank… If not you should maybe read first: The Payment Crew

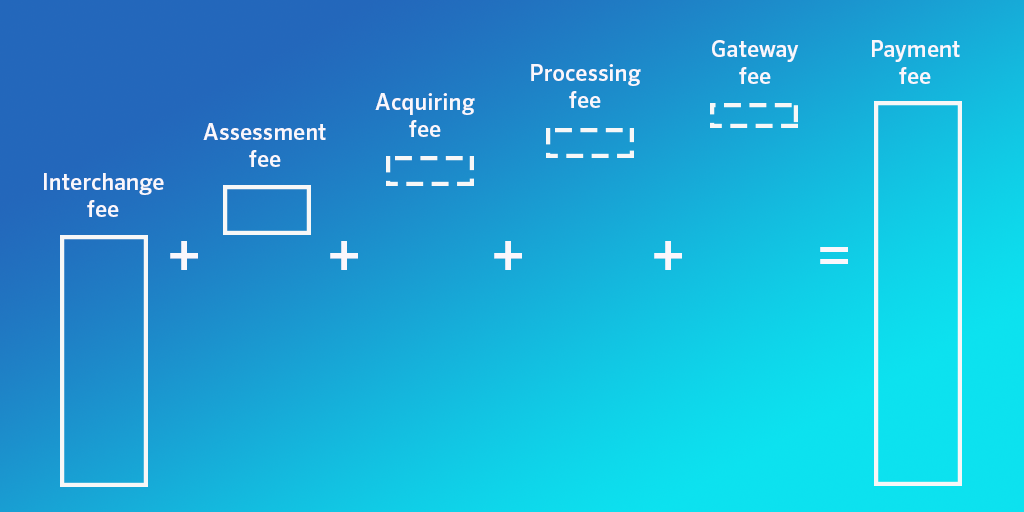

The payment fee pays the different entities involved in a transaction and is split in different layers: Interchange, Network Fee, Acquiring Fee, Processing Fee and Gateway Fee.

Interchange Fee goes to the customer bank:

Interchange Fee goes to the Issuing Bank (the bank of the customer). It represents the largest part of the total payment fee (more than 70% of the global amount). It’s a way for banks to get paid for providing a card to the customer and potentially to cover the credit risk and transaction risk. Indeed, if the transaction has been authorized by the Issuing Bank and its customer cannot pay the bank will be the one losing money.

Interchange fees vary depending of the riskiness of the transaction which depends of the type of card, of the merchant industry, of the security check made by the merchants and other factors. Risk assessment of a transaction is a large subject and we plan to make a dedicated post to explain this. Stay tuned!

Assessment Fee goes to the card network:

Assessment Fee (or Network fee or Scheme fee) is paid to the card network (Visa, Mastercard, …). It changes depending of the card network and the type of card (debit or credit). Basic assessment fees represent between 0.1% and 0.15% of the transaction but a markup can be added depending of the parameters of each transaction (cardholder’s country, merchant’s location, currency, card type…).

As you can notice Interchange and Assessment Fees are not defined by your payment provider but by your customer’s bank and by its card network. In theory Interchange fees can be negotiated by the merchant but in practice if you are not a giant like Walmart, Amazon, Apple or Ikea it will be very difficult. Most of the time Assessment fees represent a very small part of the total fee however those should be monitored as they increase for specific types of transactions.

Processor markup:

The rest of the fee, sometimes called the processor markup is for your payment provider and its affiliates. It basically pays the Acquiring, Processing & Gateway fees. Based on your number of transactions, your volume of chargebacks and your industry this fee can be negotiated!

Processor Markup =

\[Total Fee (-) Interchange (-) Assessment\]

Other fees:

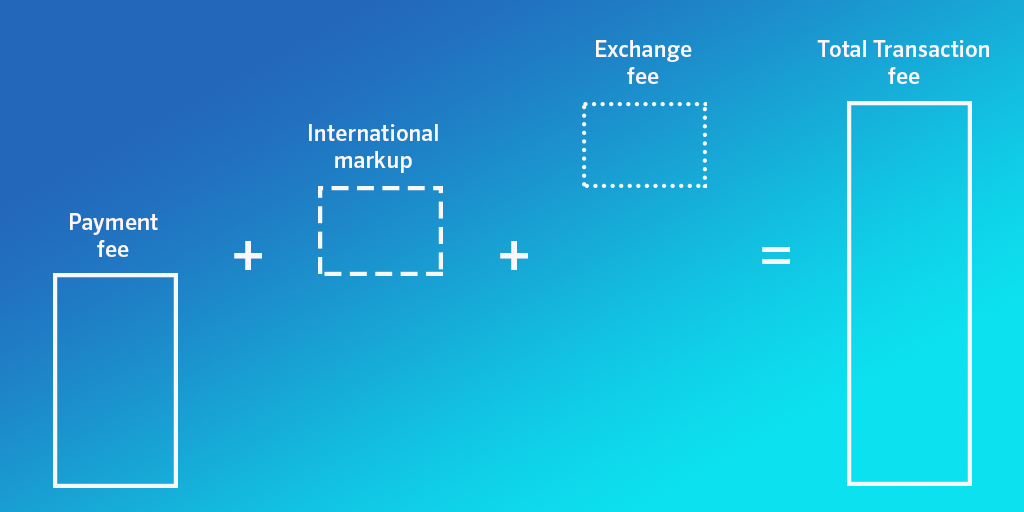

Most of the time you will pay the standard price negotiated with your payment provider. However depending of the location of your customer and the currency of the transaction you can be charged additional fees by your payment providers on top of your regular fees. Those can add more than 1% to the standard payment fee and one must pay attention to those when negotiating its contracts with its payment providers. As for risk assessment, we will cover this specific point in a dedicated post.

That’s it… for today

To summarize, on each transaction your payment provider takes a fee. It is split between the different players involved in the transaction. Interchange and Assessment Fees go to the Issuing Bank and the Card Network. They represent the largest part of the fee and are quite impossible to negotiate. The rest of the fee goes to your payment provider(s) and can be negotiated. When you negotiate don’t forget to pay attention to additional markups & exchange rates for international transactions. Next post will be focused on the 2 types of pricing you can negotiate with your payment provider: Interchange Plus vs. Tiered pricing. See you lads!