ProcessOut’s API for 3DS2 - The easiest & smartest way to manage the transition

by Manuel Huez on

A few months ago we have released our API to manage the transition for 3DS2. Its design has been centered around 3 key values: Simplicity, Flexibility & Performance. Long story short, this API is easy to integrate, manage both 3DS2 & 3DS1 protocol to offer a smooth transition and give you the opportunity to retry 3DS2 acceptance when it fails for bad reasons to help maximize your authorization rate.

Flexibility

ProcessOut is a tech company, not a bank, and does not process actual money. However, we still work with all the major players in the payment industry, giving us the flexibility to provide an up to date product continuously, allowing you to get ready for the 14th September the easiest way.

ProcessOut’s API gives you access to dozens of PSPs with one integration, keeping your payment setup up to date without any technical marginal effort. In fact, you don’t even need to understand how the 3DS2 protocol actually works to switch your transactions flow!

To ensure you the best transition, our API allows you to fall back a transaction on the 3DS1 protocol if the issuing bank is not 3DS2 ready, giving you the flexibility you need to upgrade your payment flow in a smooth way.

Transactions routing & monitoring

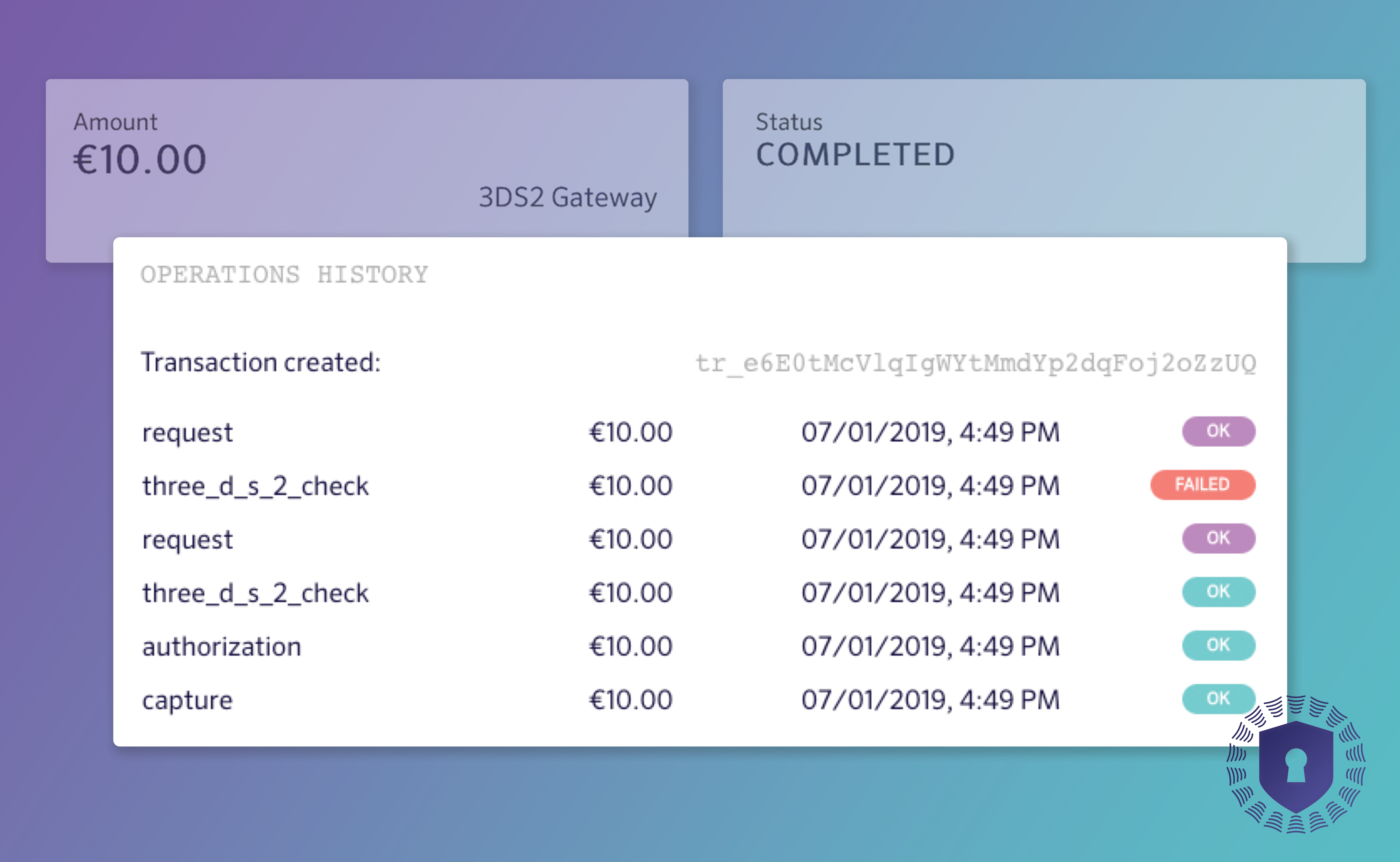

Our routing feature also allows you to retry the 3DS2 protocol acceptance when it fails for bad reasons, maximizing your authorization rate.

On top of that, ProcessOut’s dashboard provides you the best analytics to monitor the use of 3DS on your transactions, allowing you to reconcile the data from your payment providers to extract critical KPIs such as your global 3DS2 triggering rate, 3DS2 acceptance per issuing bank, and many other.

If you need to talk about your transition to 3DS2, our team will be more than happy to help! Do not hesitate to contact us!